FIN723 Quiz No. 4 Solution and Discussion

-

Quiz No. 4 Total Questions : 10

Please read the following instructions carefully!

Quiz will be based upon Multiple Choice Questions (MCQs).You have to attempt the quiz online. You can start attempting the quiz any time within given date(s) of a particular subject by clicking the link for Quiz in VULMS.

Each question has a fixed time of 90 seconds. So you have to save your answer before 90 seconds. But due to unstable internet speeds, it is recommended that you should save your answer within 60 seconds. While attempting a question, keep an eye on the remaining time.

Attempting quiz is unidirectional. Once you move forward to the next question, you can not go back to the previous one. Therefore before moving to the next question, make sure that you have selected the best option.

DO NOT press Back Button / Backspace Button while attempting a question, otherwise you will lose that question.

DO NOT refresh the page unnecessarily, specially when following messages appear

Saving…

Question Timeout: Now loading next question…Javascript MUST be enabled in your browser; otherwise you will not be able to attempt the quiz.

If for any reason, you lose access to internet (like power failure or disconnection of internet), you will be able to attempt the quiz again from the question next to the last shown question. But remember that you have to complete the quiz before expiry of the deadline.

If any student failed to attempt the quiz in given time then no re-take or offline quiz will be held.

Start Quiz

-

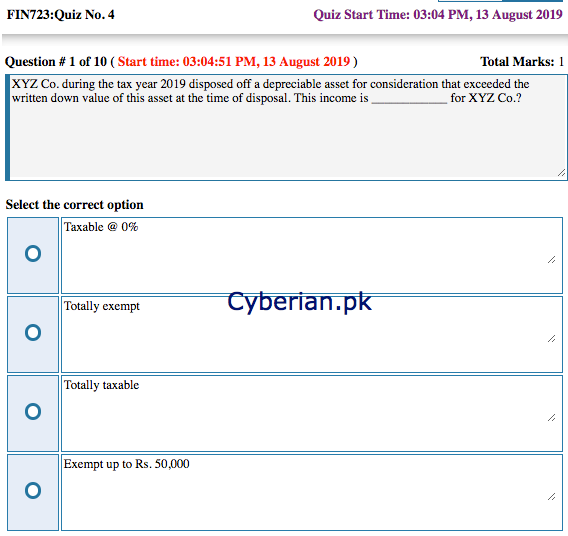

XYZ Co. during the tax year 2019 disposed off a depreciable asset for consideration that exceeded the written down value of this asset at the time of disposal. This income is ____________ for XYZ Co.?

-

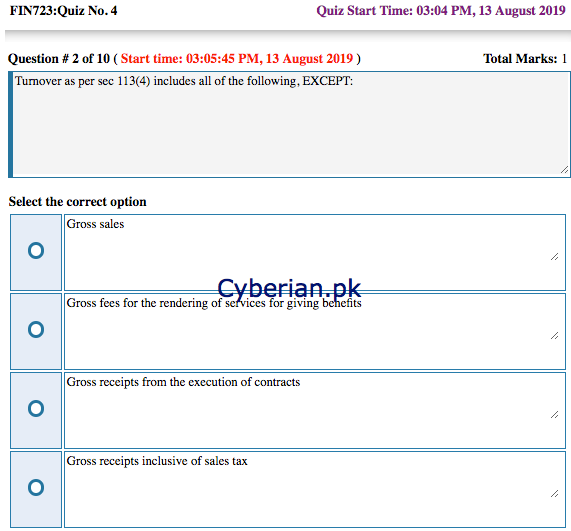

Turnover as per sec 113(4) includes all of the following, EXCEPT:

-

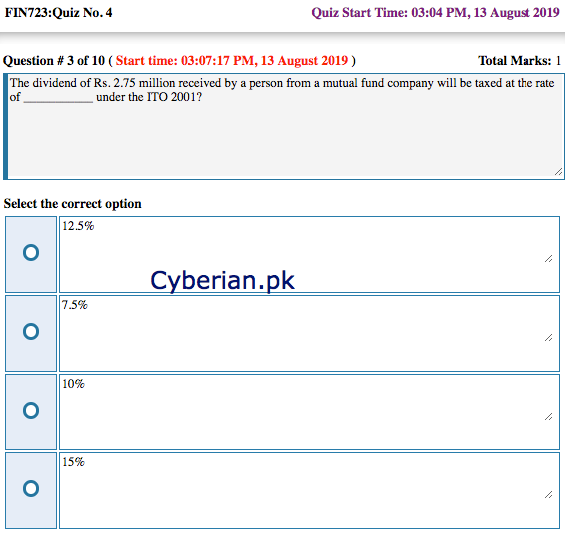

The dividend of Rs. 2.75 million received by a person from a mutual fund company will be taxed at the rate of ___________ under the ITO 2001?

-

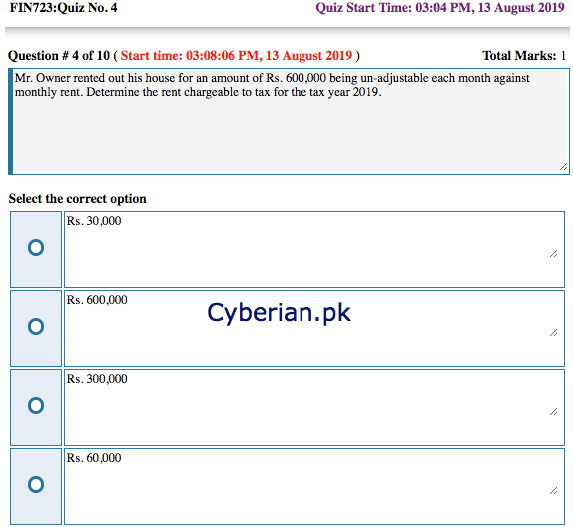

Mr. Owner rented out his house for an amount of Rs. 600,000 being un-adjustable each month against monthly rent. Determine the rent chargeable to tax for the tax year 2019.

-

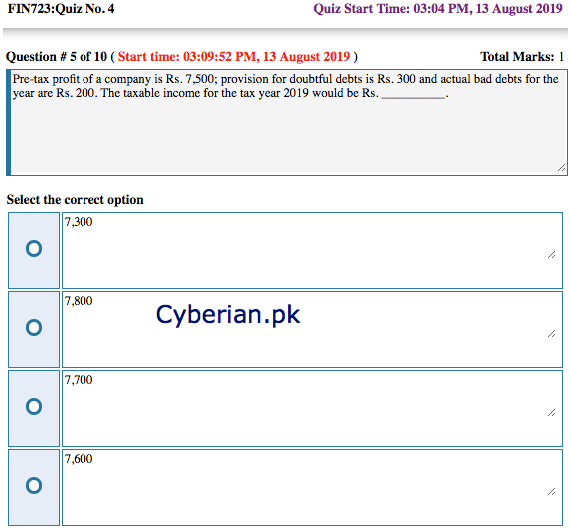

Pre-tax profit of a company is Rs. 7,500; provision for doubtful debts is Rs. 300 and actual bad debts for the year are Rs. 200. The taxable income for the tax year 2019 would be Rs. __________.

-

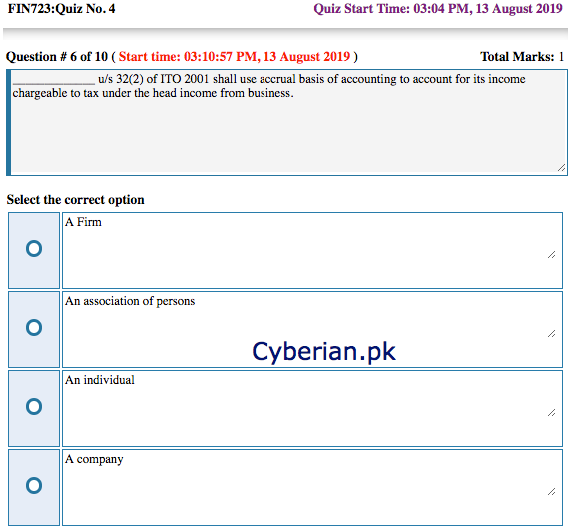

_____________ u/s 32(2) of ITO 2001 shall use accrual basis of accounting to account for its income chargeable to tax under the head income from business.

-

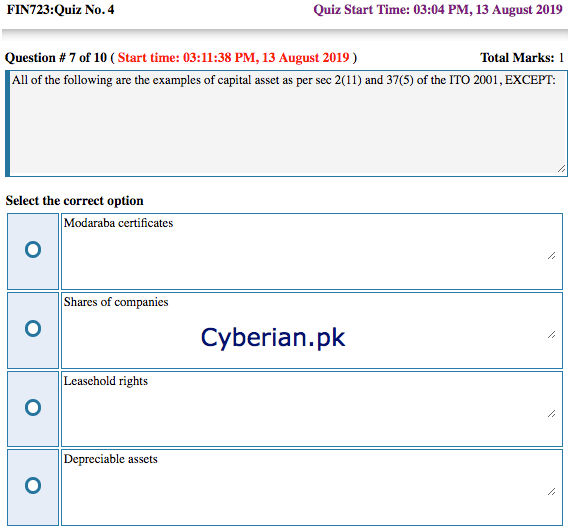

All of the following are the examples of capital asset as per sec 2(11) and 37(5) of the ITO 2001, EXCEPT:

-

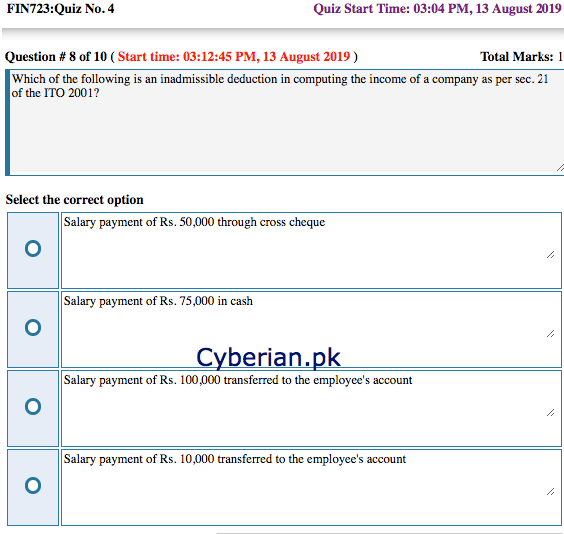

Which of the following is an inadmissible deduction in computing the income of a company as per sec. 21 of the ITO 2001?

-

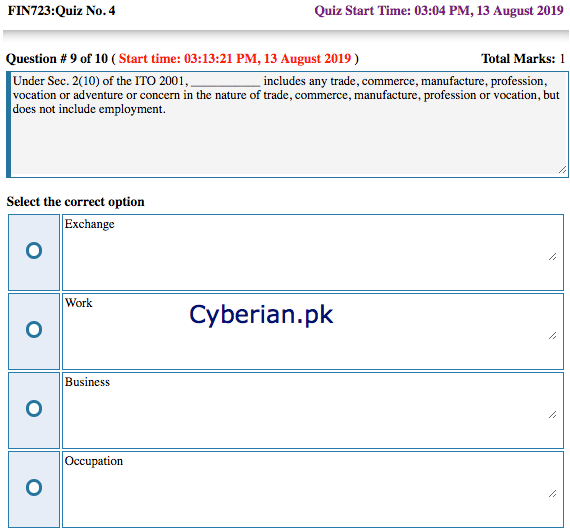

Under Sec. 2(10) of the ITO 2001, ___________ includes any trade, commerce, manufacture, profession, vocation or adventure or concern in the nature of trade, commerce, manufacture, profession or vocation, but does not include employment.

-

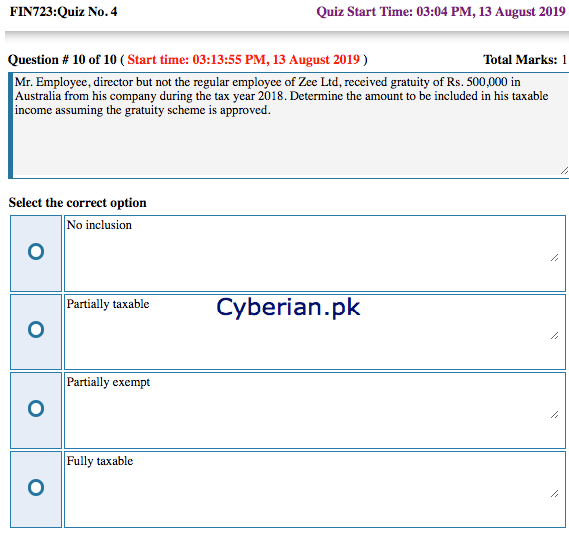

Mr. Employee, director but not the regular employee of Zee Ltd, received gratuity of Rs. 500,000 in Australia from his company during the tax year 2018. Determine the amount to be included in his taxable income assuming the gratuity scheme is approved.