FIN723 Quiz No. 4 Solution and Discussion

-

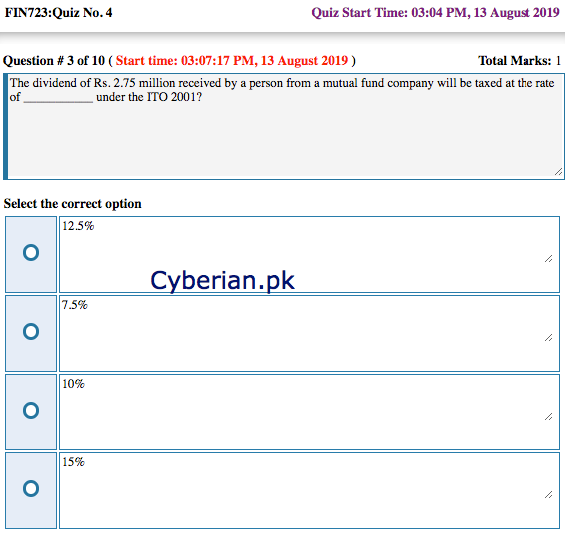

The dividend of Rs. 2.75 million received by a person from a mutual fund company will be taxed at the rate of ___________ under the ITO 2001?

-

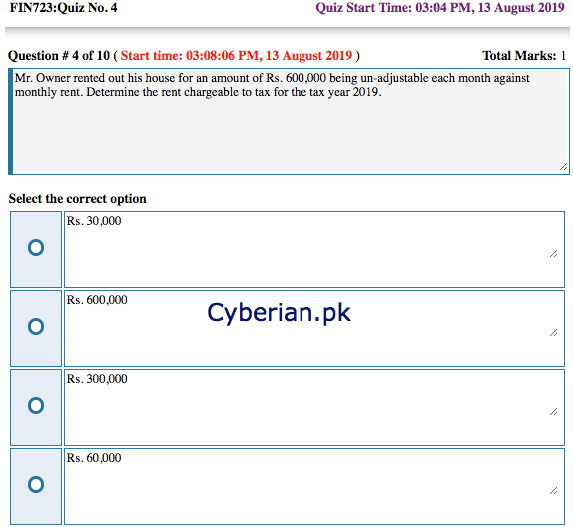

Mr. Owner rented out his house for an amount of Rs. 600,000 being un-adjustable each month against monthly rent. Determine the rent chargeable to tax for the tax year 2019.

-

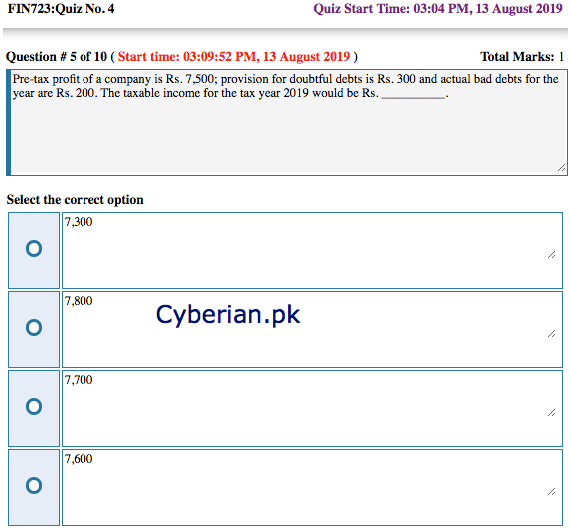

Pre-tax profit of a company is Rs. 7,500; provision for doubtful debts is Rs. 300 and actual bad debts for the year are Rs. 200. The taxable income for the tax year 2019 would be Rs. __________.

-

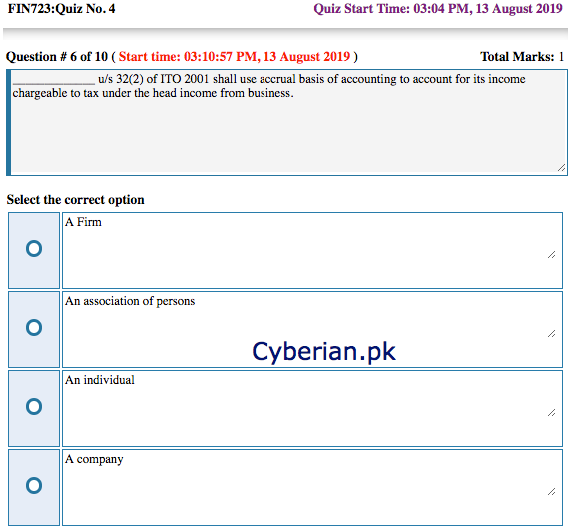

_____________ u/s 32(2) of ITO 2001 shall use accrual basis of accounting to account for its income chargeable to tax under the head income from business.

-

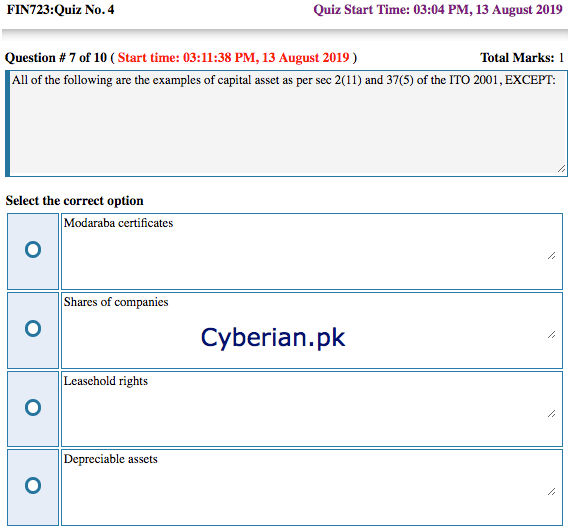

All of the following are the examples of capital asset as per sec 2(11) and 37(5) of the ITO 2001, EXCEPT:

-

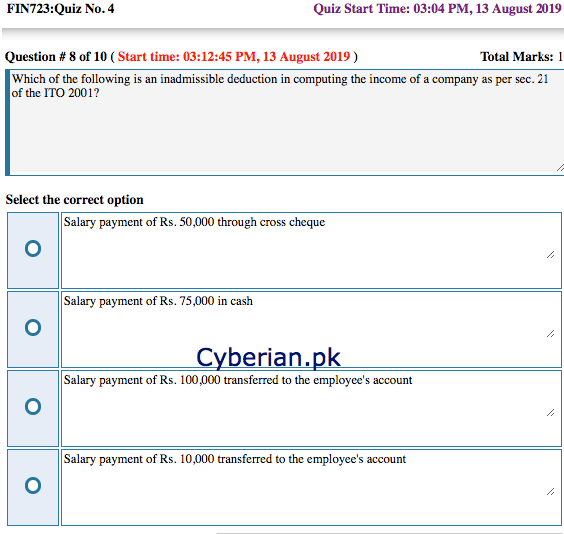

Which of the following is an inadmissible deduction in computing the income of a company as per sec. 21 of the ITO 2001?

-

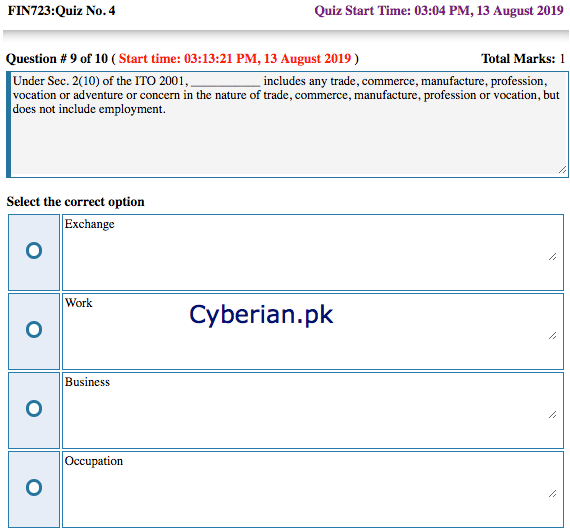

Under Sec. 2(10) of the ITO 2001, ___________ includes any trade, commerce, manufacture, profession, vocation or adventure or concern in the nature of trade, commerce, manufacture, profession or vocation, but does not include employment.

-

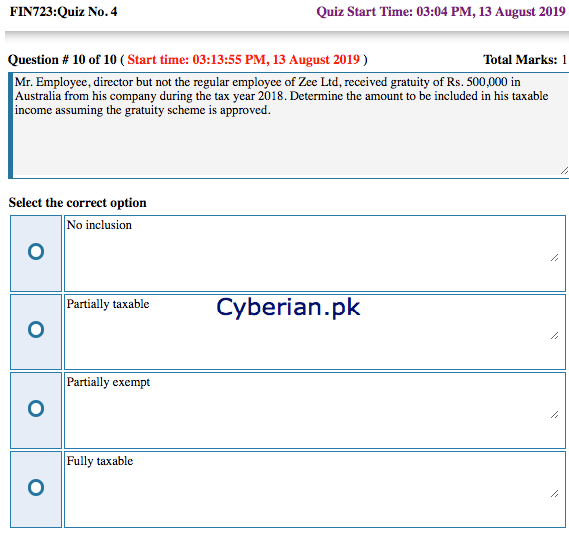

Mr. Employee, director but not the regular employee of Zee Ltd, received gratuity of Rs. 500,000 in Australia from his company during the tax year 2018. Determine the amount to be included in his taxable income assuming the gratuity scheme is approved.